Power traders

Power traders need to create a competitive edge. With KYOS advanced analytics they obtain a better understanding of power flows and price movements, which help to identify trading opportunities.

Software Models for power traders to suit your needs

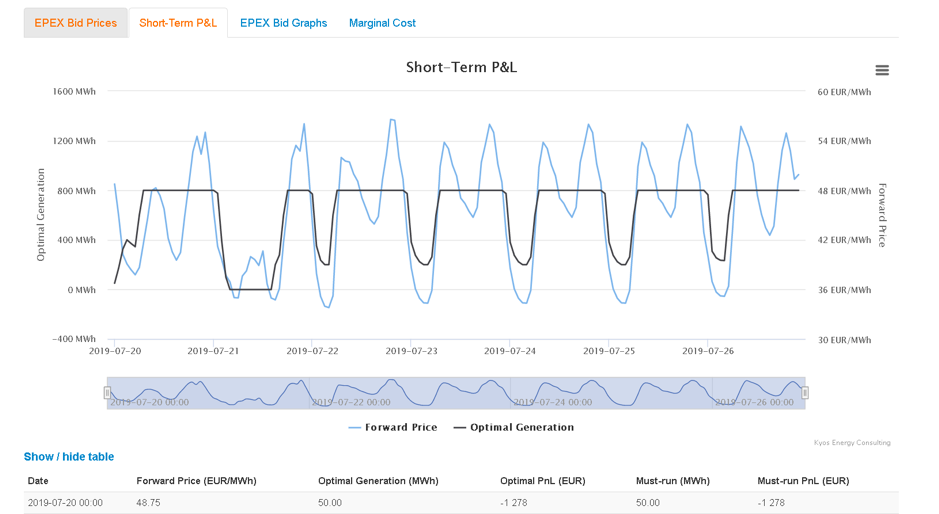

- Many power deals involve optionalities. Examples include spark and dark spread options and time spread options. Accurate pricing and hedging of these products is essential to making money. KYOS offers best-in-class option valuation models for energy markets. For example we have KyOption to price a wide range of options. If you need valuations for optimal dispatch, then KyPlant is the answer.

- In addition, keeping risk under control is key for success in energy trading. For all power traders we offer a complete deal capture and portfolio management system, including a Value-at-Risk engine. If desired, you can extend this model with Cashflow-at-Risk and Earnings-at-Risk.

- Furthermore KYOS offers a fundamental market model, KyPF. Based on information of all power plants in the market, together with fuel and load forecasts, it finds the equilibrium market prices. Traders can analyze a range of assumptions and see how they work out on future power price levels. Calculations are very fast, so many scenarios can be analyzed and action readily taken.

Loading a qoute..

Loading a qoute..

Solutions

Power companies

Publications

- White paper: Benefits of outsourcing energy analytics

- World Power: uncertainties in wind production often priced at too low levels

- Energy Risk: Comparing power plant delta hedging strategies

- Live price curves for contract pricing and dispatch optimization

- Report: Multi billion euro loss for Dutch coal plants

Trusted by organizations all over the world

Other Industries

Renewables

Sources of renewable power or green energy are the future. KYOS helps you with valuing your solar, wind, battery or pumped-hydro energy assets, as well as your (renewable) power purchase agreements (PPAs).

Read more ›Natural gas

Natural gas portfolio management is all about managing price and volume risks. KYOS helps to optimize natural gas storage and swing contracts, and trade in the markets to maximize the flexibility value.

Read more ›Multi-commodity

Large industrial companies are exposed to a variety of commodities. To successfully operate in a competitive market, commodity earnings risk should be well understood and managed effectively.

Read more ›