LNG: Room for one extra regas terminal in Northwest Europe

Europe absorbed big parts of recent LNG project additions

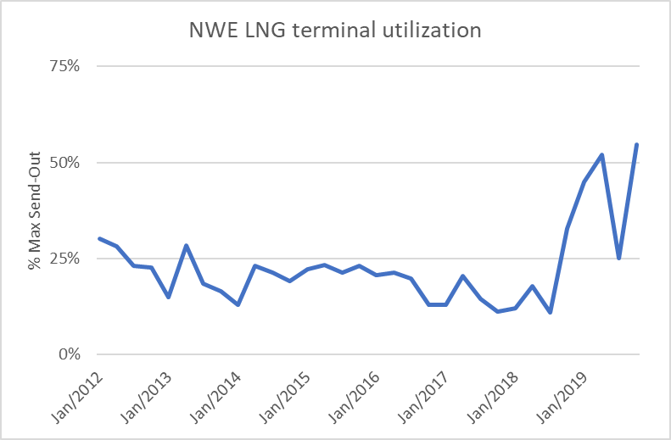

LNG imports into Europe sharply increased since the fourth quarter of 2018. Imports into Northwest Europe increased with 33bcm in 2019 as compared to 2018[1]. This can clearly be seen in utilization rates of the Northwest European (NWE) regas terminals.

The average send-out usage jumped to 40% in 2019 as compared to – on average – 15% in the years before. Due to a combination of operational, technical and logistical constraints, terminals cannot use the technical maximum send-out capacities flat over the year. The maximum achievable utilization rates is estimated to be around 70-80%.

The main reason for the extra imports is the wave of new liquefaction plants that came online [2]. Global LNG imports increased with almost 45bcm in 2019. New gas demand outside Europe, especially in Asia, was not able to absorb all this extra supply of LNG. Furthermore, warmer than usual winters in for example China, South-Korea and Japan accentuated this pattern.

Europe is in a unique position in the global LNG world. Due to its many and flexible gas supply sources, ample availability of gas storage and fuel switching potential in the electricity sector, it can act as swing demand for global LNG. As a result, many LNG cargoes found their way to Europe.

More LNG projects coming on-line

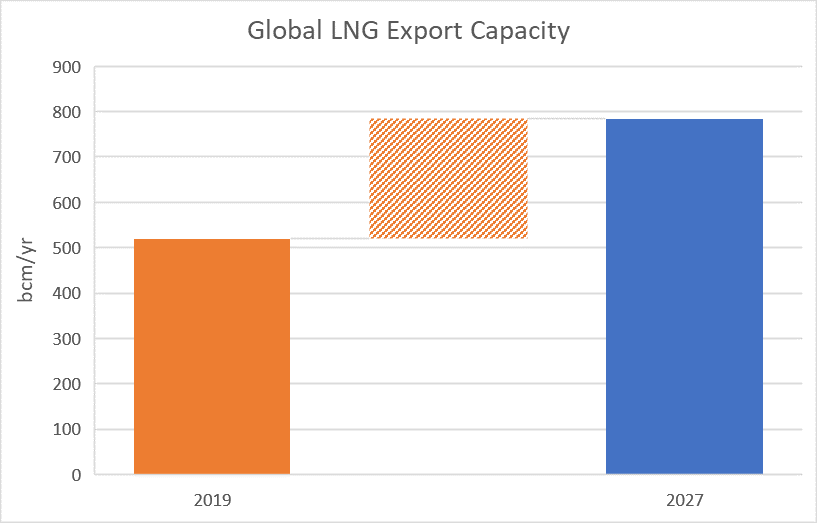

Over the coming years, various new LNG liquefaction projects will come online. Until 2027 an impressive 265bcm of LNG volumes is expected. This means a growth of almost 35bcm per year in LNG supplies. LNG demand increase since 2010 only showed such levels over the course of two years. Therefore, it is expected that part of this increase in LNG volumes will find its way to Europe. Furthermore, year on year seasonal gas demand fluctuations in especially China and South-Korea will require balancing of LNG volumes. Again, these cargoes will predominately flow to Europe. The trend towards more flexible LNG contracts will also further enhance this development.

How much room is there for extra regas terminals in NWE?

We assume that in the high case, a maximum of 66bcm (or 25%) of additional LNG supply will not be matched with new demand and will therefore come to Europe. Current regas terminals in Northwest Europe can absorb only an additional 50-60bcm of LNG by increasing the utilization rates to 70-80%. Therefore, more regas terminals are required. Currently, three German regas projects are under development, with a total capacity of 26bcm. The various projects communicated an expected start of commercial operations around 2022-2023.

In our view there is only room for a maximum of at most one additional regas terminal in Northwest Europe. Furthermore, the projects need to be very competitive, both in commercial and in operational terms, to compete with existing LNG terminals.

KYOS can support you with understanding the LNG market

Use KYOS’ analytical knowledge to value flexibility in both pipeline and LNG contracts. With the new Custom Analytics functionality of our Analytical Platform it is possible to quickly and flexibly price new contract structures. KYOS’ well known Monte Carlo Engine KySim is the heart of all valuations of flexible contracts. Customer can use KYOS’ out-of-the-box valuation models, or create custom made scripts in Python to price contract structures. Results can be combined to assess the overall risk profile of your portfolio. Our consultants can help to value and risk manage your LNG portfolio.

Please contact us for more information: info@kyos.com

[2] OIES Natural Gas Quarterly (Jan 2020)