Natural gas suppliers and utilities

Natural gas suppliers and utilities have to manage a wide variety of contracts, with suppliers and customers. Their sourcing portfolio must have the right level of volume flexibility to deal with unexpected volume variations. But what is the right mix of swing contracts, storage contracts and market trades? In addition, how can the trading operations be optimized? Furthermore, what is a fair price for customers with flexible offtake? KYOS Analytics assists gas supply companies to deal with these questions.

Natural gas markets are volatile and small price variations can easily destroy the small margins for gas suppliers and utilities. Market volatility also offers opportunities for supply companies having access to storage and swing contracts: buying and selling in the spot market at the right time is an important source of option value. Above all, dealing with market price uncertainty is the key feature of the KYOS applications for gas supply companies:

- Provide forward curves for pricing contracts and marking-to-market positions

- Generate price, temperature and volume simulations for assessing risks

- Calculate delta hedges of storage and swing contracts to secure profits

- Calculate the option extrinsic value of flexible assets and contracts

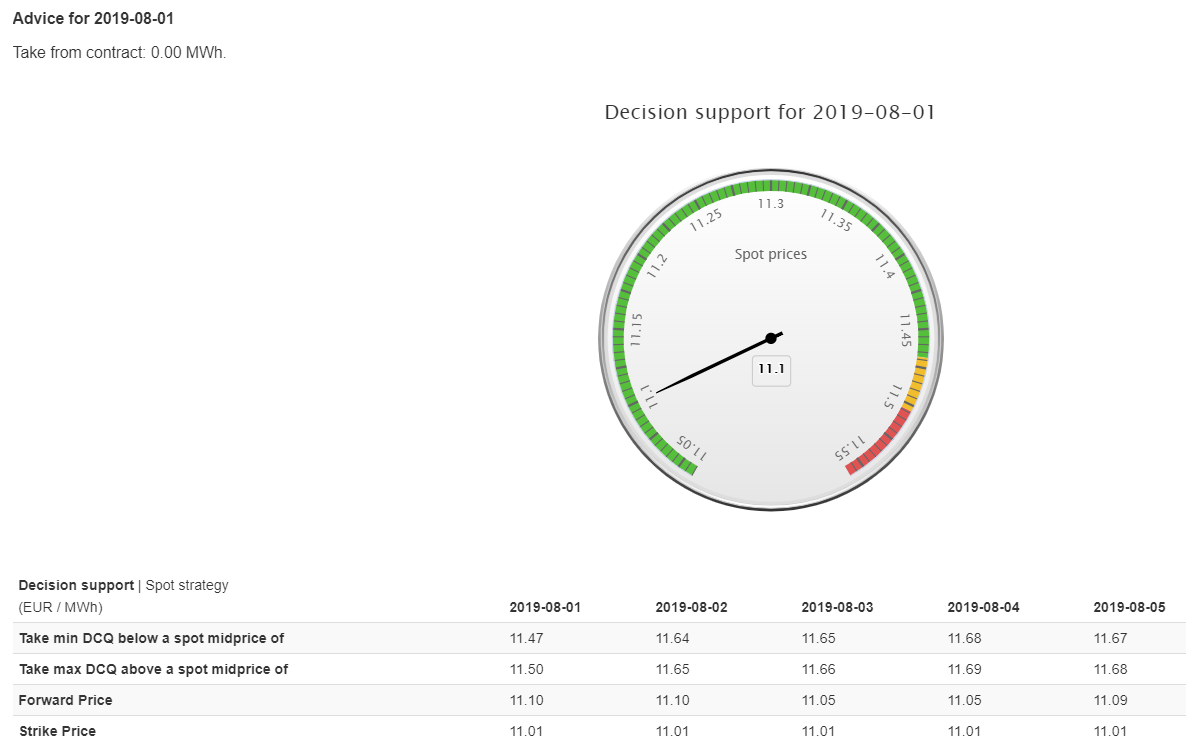

- Optimize spot decisions of gas storage and flexible swing gas contracts

- End of day pricing and marking-to-market of all positions and contracts

Loading a qoute..

Loading a qoute..

Solutions

Gas companies

Publications

- White paper: Benefits of outsourcing energy analytics

- Journal of Energy Markets: Gas storage valuation using a multi-factor price process

- White paper: Guidelines for valuation of real options in energy markets

- A practical example of hedging gas swing contracts

- Journal of Derivatives: Gas storage valuation using a Monte Carlo method

Trusted by organizations all over the world

Other Industries

Renewables

Sources of renewable power or green energy are the future. KYOS helps you with valuing your solar, wind, battery or pumped-hydro energy assets, as well as your (renewable) power purchase agreements (PPAs).

Read more ›Power

Where are power prices going? What is the value of my power station or contract? How can I trade in the market to reduce electricity price risks? KYOS analytics provide answers.

Read more ›Multi-commodity

Large industrial companies are exposed to a variety of commodities. To successfully operate in a competitive market, commodity earnings risk should be well understood and managed effectively.

Read more ›