What is the Balancing Mechanism?

The Balancing Mechanism, or BM, is the main mechanism used by National Grid, the TSO in Great-Britain, and by EirGrid, the TSO in Ireland, to balance electricity supply and demand close to real time. Other countries have similar mechanisms and markets for managing the system balance after gate closure.

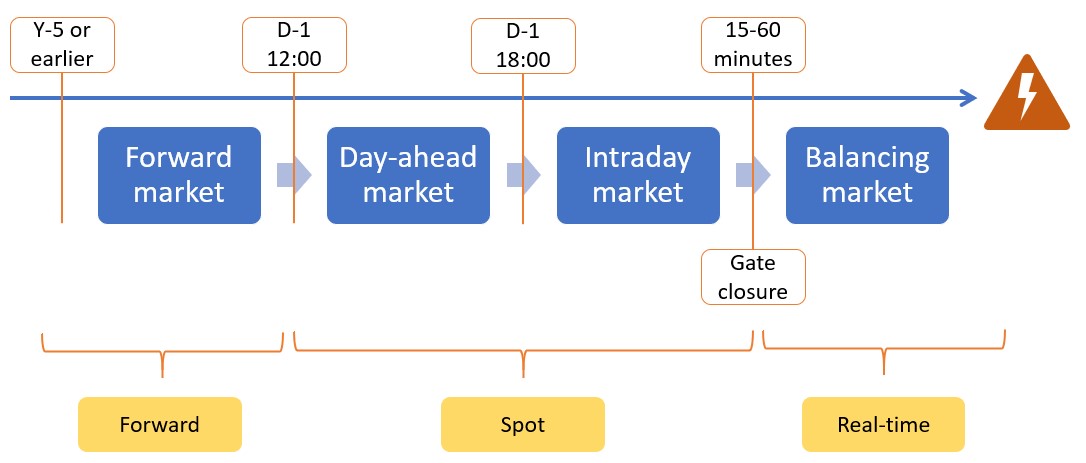

The diagram shows approximate times for the different transfers between the market segments. At the moment, the exact EPEX Auction times are[1]:

- Day ahead hourly auction is at 12:00

- Day ahead half-hourly auction is at 15:30

- Intraday half-hourly auction is at 17:30

- Intraday half-hourly auction is at 8:00

When the TSO predicts that there will be a discrepancy between electricity production and demand during a certain time period, it may accept a ‘bid’ or ‘offer’ from a market participant to either increase or decrease generation (or consumption). The operation of the BM relies on the flow of data and information between the TSO and market participants. This happens in real time to ensure that system balance is maintained. The TSO specifies the interfaces that must be used for these processes, to comply with the Balancing and Settlement Code (BSC).

The process of the Balancing Mechanism is as follows:

- Each generator provides a detailed specification of the characteristics of its Balancing Mechanism Units (BMUs), its generation assets. In the GB market this is called Dynamic Data and Ireland refers to Technical Offer Data (TOD). In both cases, the data set contains detailed information about technical capabilities of the BMU. For example, it defines how long it takes to make a cold, warm or hot start, how the generation level is ramped up or down, what are the minimum on and off times, and other relevant generation data.

- Every day, each generator bids into the day-ahead market. After the day-ahead auction results, the market generator knows which bids have been accepted.

- Then the intraday trading process starts, in which the generators buy and sell power with other market participants. The intraday trading activity allows the generators to achieve a feasible and often more profitable dispatch of their asset.

- Trading activity up to gate closure must be notified to the market operator, in the GB market being Elexon. These trades, submitted as Electricity Contract Volume Notifications (EVCNs), establish the position for each generator up to gate closure.

- Before gate closure, the planned dispatch of the power generation asset, is sent to the Electronic Data Transfer (EDT) system of the TSO. The dispatch pattern is the Final Physical Notification (FPN) and consists of a series of elbow points. The elbow points contain the levels of production (in MW) at each half-hour, and all other minutes where there is a change in the speed of ramping up or down. The elbow points are the official schedule of the generation asset (BMU).

- After gate closure, the TSO is responsible for maintaining system balance. The prices at which the TSO may vary the production of generation assets after gate closure, are submitted by the generators via bids and offers. Based on these bids and offers, the TSO issues instructions to the generators to adapt their production in the form of Bid Offer Acceptances (BOAs). The TSO ensures that the variations in production are feasible for the generator, i.e. in line with the TODs of the generation assets and the original dispatch schedule (the elbow points). When accepting these instructions, participants must then act to ensure that their BM units produce the required level of output. A failure to do so results in an imbalance. The variations in production are reconciled and (in the GB market) settled through Elexon’s Central Services. An important distinction between the BM and the wholesale spot markets is that all participants are ‘paid as bid’ not paid the price of the marginal provider of energy.

The TSOs in GB and Ireland use the Balancing Mechanism as the primary means to balance the system. However, they also use other mechanisms provided as ancillary services by market participants. These include e.g. the Firm Frequency Response (FFR), the short term operating reserve (STOR), Fast Reserve (FR) and Black Start.

Specialized optimization and decision support software assists generators in the Balancing Mechanisms in the GB and Irish markets. An example is the KYOS PN (Physical Notification) software. This real-time trading software uses very detailed information from the power plants and real-time information from the BM to inform the traders about the optimal dispatch of their generation assets and optimal bids and offers in the BM. It also takes care of the communication, via other software, with the TSO.

See also our FAQ on Spot power trading.

For more information about our offerings for the power producers, suppliers and traders, see our page KYOS solutions for power.

References

[1] https://www.epexspot.com/sites/default/files/download_center_files/20-01-24_TradingBrochure.pdf