What is spot power trading?

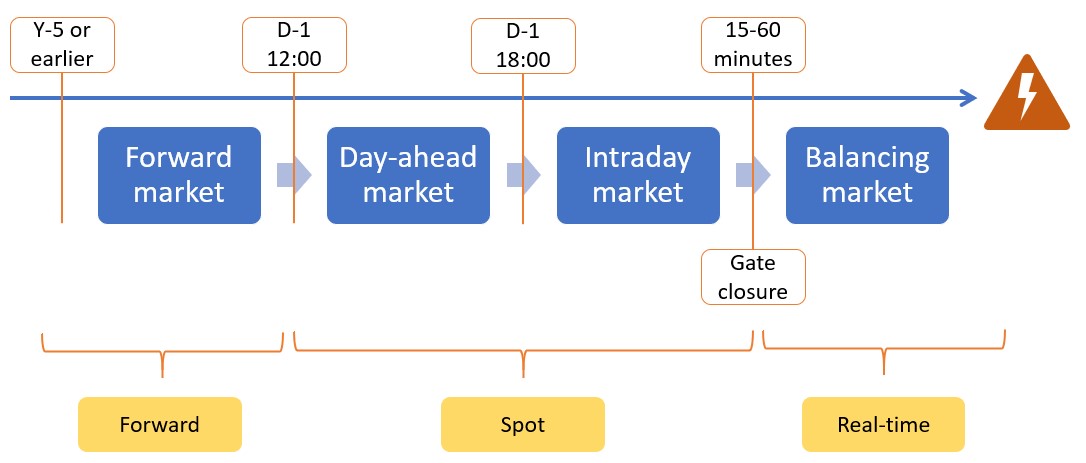

Spot power trading is generally defined as the trading of power in the wholesale market from day-ahead until just before delivery, gate closure. Day-ahead trading on a central day-ahead auction has traditionally been the main market mechanism for spot power trading. However, in response to the increasing penetration levels of intermittent renewable power generation, such as solar and wind, trading dynamics have moved to shorter horizons than day-ahead. Between day-ahead and actual production, the weather patterns can still change significantly, thereby changing the output from renewable generation. Being able to adjust trading positions accordingly, has become a key element to short-term balancing the portfolios of the power market operators, and thereby also balancing the system.

Spot trading can be divided into several segments:

- Day-ahead auctions for delivery D+1

- Intraday auctions for delivery D+1 or on the same day D

- Continuous trading for delivery D+1 or on the same day D

- Very short-term balancing trades with the TSO for delivery within the next 60 minutes or so

Day-ahead and intraday trading takes place via exchange auctions, continuous exchange trading and continuous over-the-counter (OTC) trading. The largest spot power exchanges in Europe are EPEX Spot and Nord Pool. Other spot power exchanges are often active in just one country, such as PTE in the Polish market and GME in the Italian market. Together with other energy exchanges, they are members of the Association of European Energy Exchanges, Europex. Markets organized by exchanges are anonymous and accessible to all participants satisfying admission requirements. They perform an important role in the pooling of liquidity, transparency, application of market regulation, payment and delivery security.

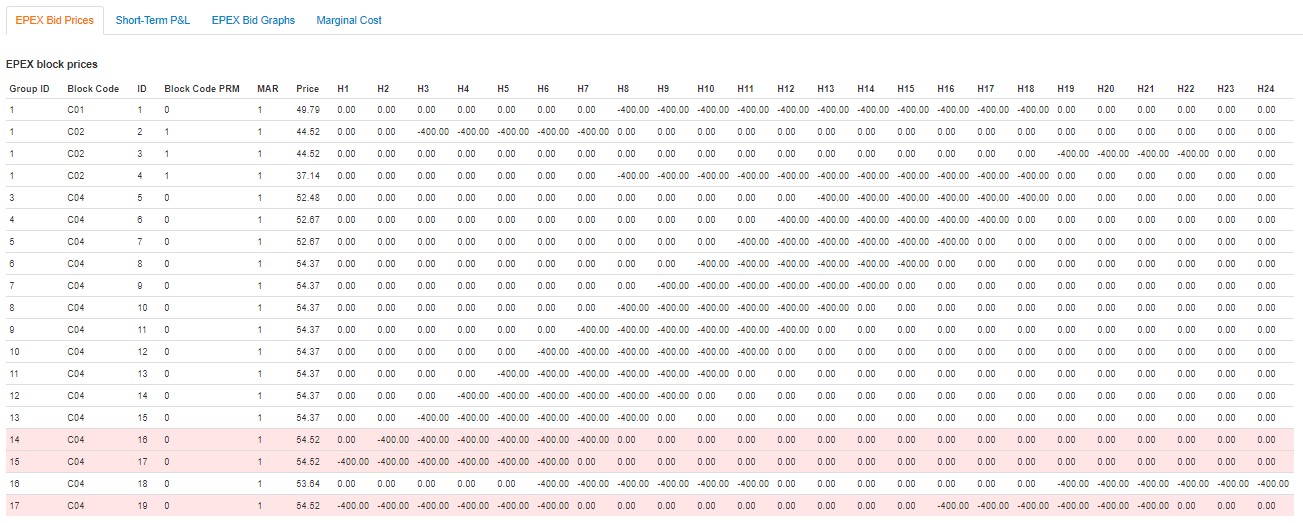

Market participants in day-ahead spot markets place bids and offers for individual hours or half-hours on the next day. Exchanges also offer the possibility to trade blocks of hours and to group the block bids and offers into families of children and parents. This is especially relevant for power generators which prefer to have continuous production in a series of hours to avoid start-stop costs.

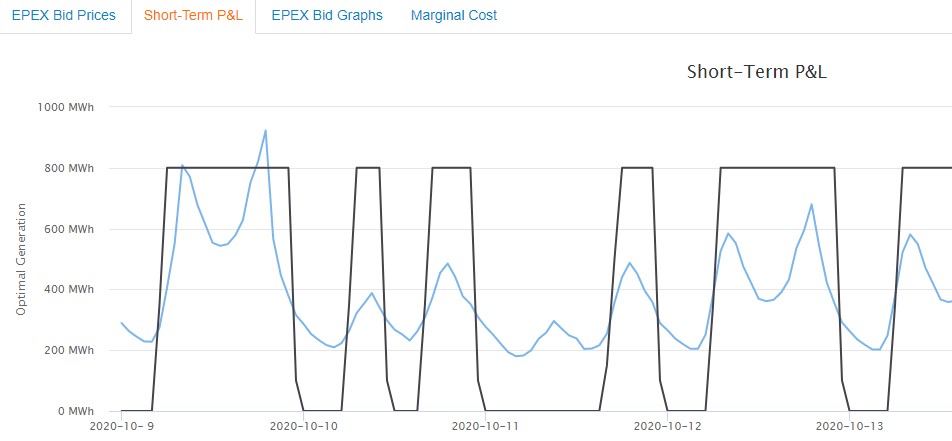

As intraday and balancing markets evolve, so does the necessity to trade as close as possible to the time of delivery. This increases the challenges for power generators in the management of their dispatch operations and maintaining a balanced position. This applies to both intermittent generation, such as solar and wind, as well as flexible power generation, such as conventional assets (gas, coal, biomass, nuclear), hydro power and batteries.

What is the Balancing Mechanism?

For more information about our offerings for the power producers, suppliers and traders, see our page KYOS solutions for power.