Gas: Gas storage

- Increase revenue & manage risks of gas storage products

- Captures all storage characteristics

- Quick calculations, fully automated

- Easily interfaced with market data

- Accurate valuations and hedges via LSMC methodology

Benefits

1. Spot Market: inject or withdraw?

Each day, the gas storage optimization model tells you what is optimal to do: inject or withdraw. Boundary prices indicate below which price you should inject and above which price withdraw. Together with boundary prices of other storage assets and swing contracts, a portfolio manager can rank the assets from low opportunity cost to high opportunity cost, creating an internal merit order for portfolio optimization.

Each day, the gas storage optimization model tells you what is optimal to do: inject or withdraw. Boundary prices indicate below which price you should inject and above which price withdraw. Together with boundary prices of other storage assets and swing contracts, a portfolio manager can rank the assets from low opportunity cost to high opportunity cost, creating an internal merit order for portfolio optimization.

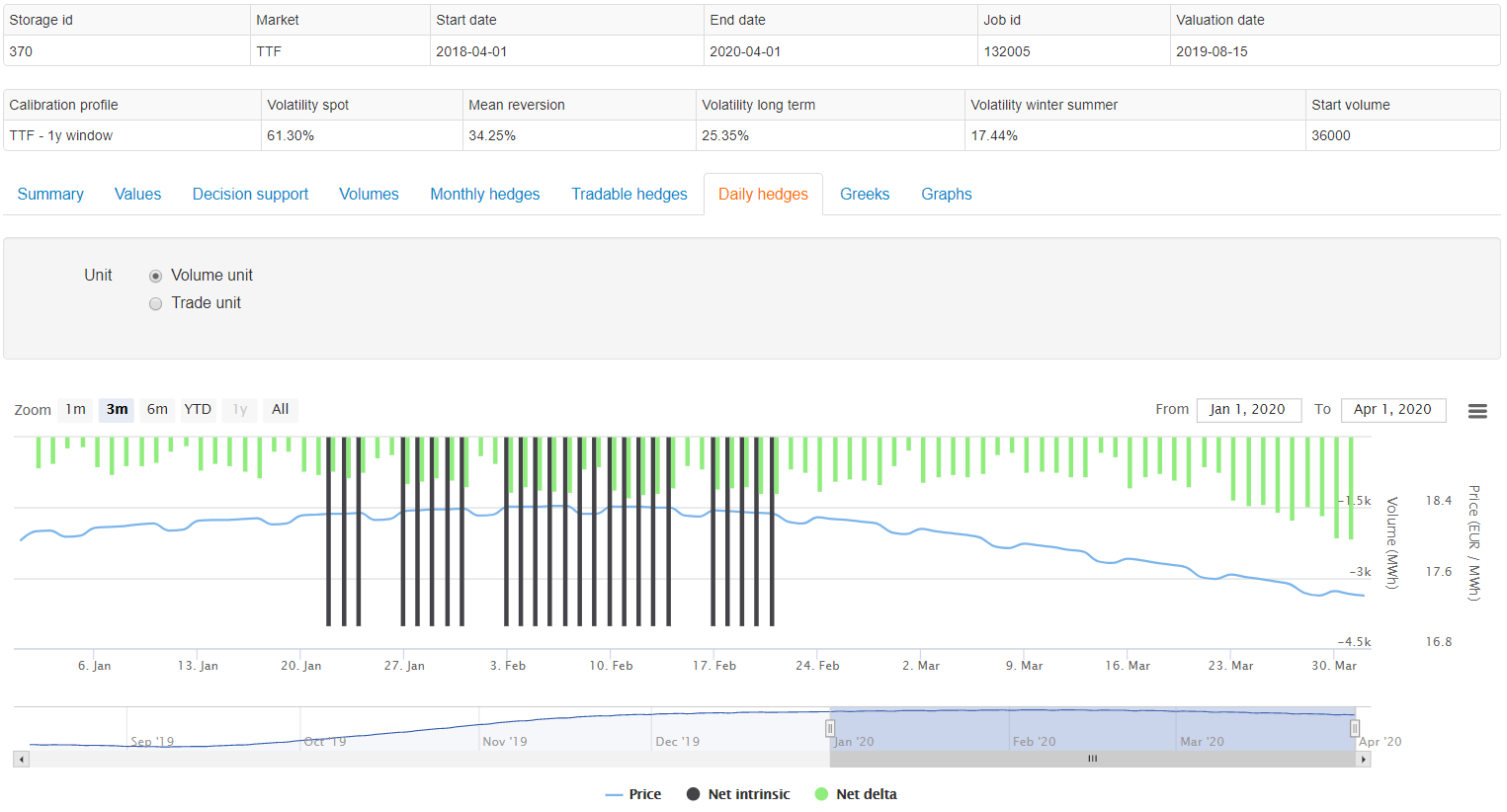

2. Forward Market: keep the risk or lock in profits?

KyStore shows which forward transactions are optimal to hedge risks and lock in profits. The user can for instance choose between intrinsic hedging and delta hedging, two strategies to secure profits. It can provide hedge recommendations for the asset alone, for multiple assets together or for a portfolio of assets and existing trading positions.

3. Storage market: what is a fair price?

Finally, the storage model answers the question: how much should I pay for storage? The gas storage optimization model shows which part of the value is intrinsic, and can be made easily, and which part is extrinsic, requiring a more active trading strategy. Extrinsic values are derived from an intuitive and realistic Monte Carlo simulation model. In addition, wee apply a combination of forward and spot trading strategies to the simulated price scenarios, using rolling intrinsic and least-squares Monte Carlo. As a result, this type of valuation provides a fair assessment of the future value.

Furthermore, backtesting of the model is another feature: it shows how much money you would have made in the past, following a specific trading strategy.

Loading a qoute..

Loading a qoute..

Features

All storage characteristics are included in the gas storage optimization software. This includes not only time and volume dependent injection and withdrawal rates, but also time varying costs, interruption rights and reduced availability because of maintenance.

Last but not least, KyStore is fully embedded in the KYOS Analytical Platform. Automated data feeds ensure that you get up-to-date trading recommendations every day. Transparency is guaranteed, because analysts can evaluate each individual price scenario.

Methodology gas storage optimization

The gas storage optimization software uses advanced Monte Carlo simulation techniques. Important characteristics are a mean-reverting multi-factor model with long-term, short-term and seasonal dynamics. Users can also import their own price simulations or use those of KySim.

KyStore model applies Least Squares Monte Carlo techniques to calculate the optimal storage trading and operating decisions. Furthermore, the accompanying calibration tool uses historical data to easily derive the volatility term structure and other simulation inputs. Similarly, you may use implied option volatilities as well, by overwriting the historical volatility estimates.

Subjects

Publications

- White paper: Benefits of outsourcing energy analytics

- Journal of Natural Gas Science and Engineering: Gas storage review article

- A practical example of hedging gas swing contracts

- Journal of Energy Markets: Gas storage valuation using a multi-factor price process

- Journal of Derivatives: Gas storage valuation using a Monte Carlo method

Trusted by organizations all over the world

Other Solutions

Software - Energy Analytics

Do you need help with valuing a renewable investment project, PPAs, battery energy storage, power plant, electrolyser, gas storage, - or you need bankable price forecasting services, risk management advisory or an E-/CTRM system?

Read more ›Software - C/ETRM

Customize your own C/ETRM system, with advanced risk metrics and reporting tools. Bring together your physical commodity positions with financial contracts. This provides not only a complete picture of purchases and sales, but also of the financial risks you are exposed to.

Read more ›Price Analytics

Market prices, market price forecasts and simulations for short and long-term are essential ingredients in energy and commodity management. KYOS offers a suite of functions and quant models to create and analyze all these price series.

Read more ›Advisory & Data Services

KYOS Energy Consulting offers a wide range of services to support companies with managing their (renewable) production position. Our expert services range from a one-off deal valuation to a complete solution for the risk management of a portfolio of renewable generation assets and contracts.

Read more ›