Natural gas traders

Natural gas traders need to create a competitive edge. With KYOS advanced analytics they obtain a better understanding of gas flows and price movements, which help to identify trading opportunities.

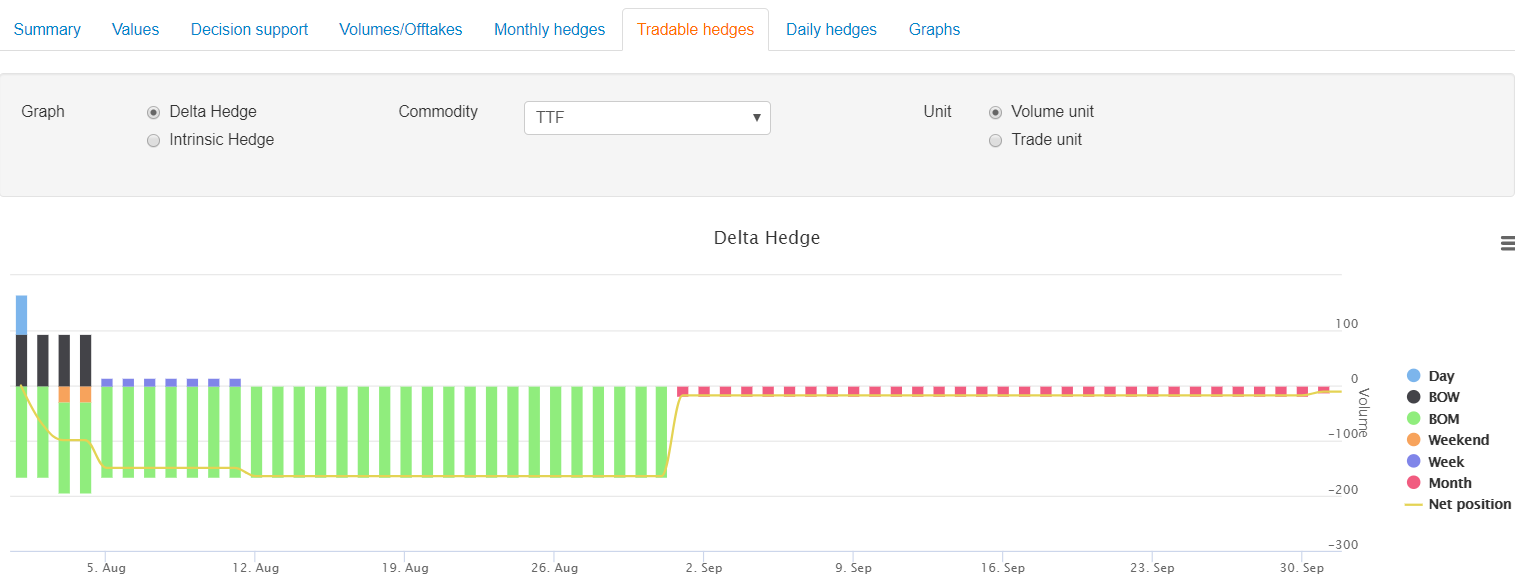

- Many gas deals involve optionalities. Examples include time spread options, swing options (especially in gas) and storage options. Accurate pricing and hedging of these products is essential to making money. KYOS offers best-in-class option valuation models for energy markets.

- Keeping risk under control is key for success in energy trading. For all natural gas traders we offer a complete deal capture and portfolio management system, including a Value-at-Risk engine, possibly extended with Cashflow-at-Risk and Earnings-at-Risk.

- KYOS provides all the tools to create your own forecasting tools for gas flows and gas prices. That is what some of our customers have done. For example, the KYOS software predicts the operations of all gas storage assets in the market. When these forecasts are compared with demand and supply, potential shortages and surpluses can be identified.

Loading a qoute..

Loading a qoute..

Solutions

Gas companies

Trusted by organizations all over the world

Other Industries

Renewables

Sources of renewable power or green energy are the future. KYOS helps you with valuing your solar, wind, battery or pumped-hydro energy assets, as well as your (renewable) power purchase agreements (PPAs).

Read more ›Power

Where are power prices going? What is the value of my power station or contract? How can I trade in the market to reduce electricity price risks? KYOS analytics provide answers.

Read more ›Multi-commodity

Large industrial companies are exposed to a variety of commodities. To successfully operate in a competitive market, commodity earnings risk should be well understood and managed effectively.

Read more ›