Renewable: Energy storage

- Puts a price to all types of energy storage

- Make quick calculations, fully automated

- Enjoy easy interfaces with market and other data

- Fully embedded in KYOS Analytical Platform

The KyBattery Energy Storage Optimization model is our solution to value energy storages, including battery and pump-hydro assets. It assesses future value in day-ahead, intra-day, imbalance and ancillary service markets (FCR and aFRR). It is actively used by our clients and by the KYOS consulting team to assess business cases and provide bankable revenue forecasts in almost all European markets.

The KyBattery Energy Storage Optimization model is our solution to value energy storages, including battery and pump-hydro assets. It assesses future value in day-ahead, intra-day, imbalance and ancillary service markets (FCR and aFRR). It is actively used by our clients and by the KYOS consulting team to assess business cases and provide bankable revenue forecasts in almost all European markets.

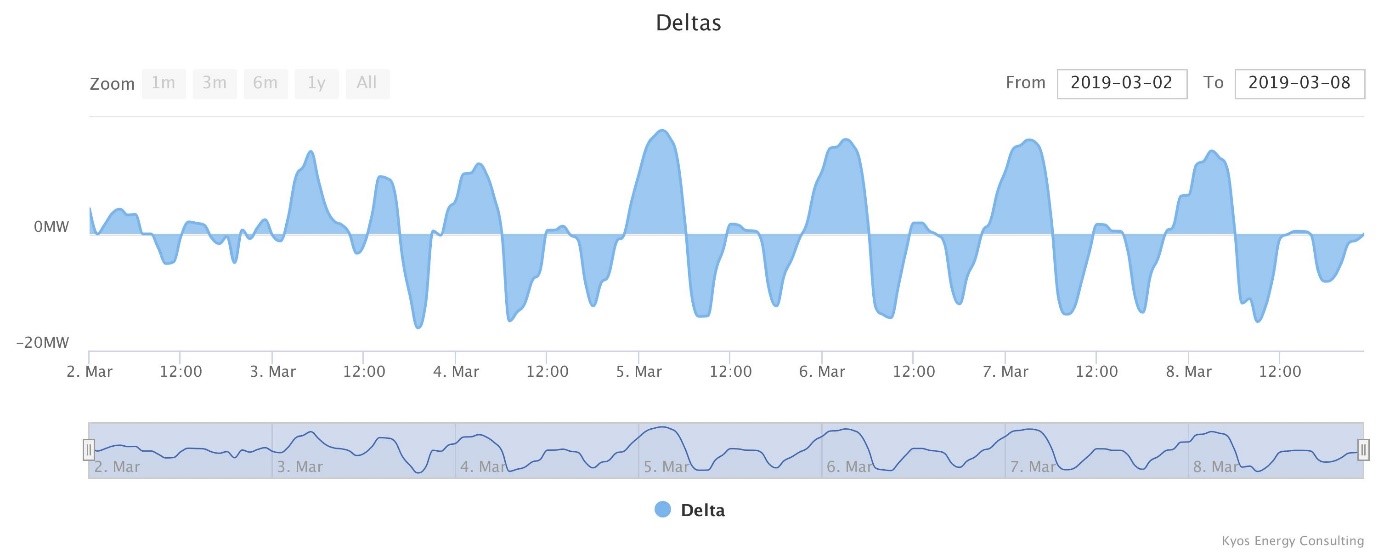

Next to KyBattery, we offer a real-time battery optimizer for intraday trading. The Battery Optimizer provides real-time trading signals to optimizers, which they can use to boost their profits. It can also be used for very realistically benchmarking trading performance of other strategies, or to design optimal bidding strategies in ancillary service markets.

KyBattery supports all types of energy storage assets, including pumped hydropower storage, battery storage, hydrogen storage, compressed air energy storage (CAES) and heat storage. All of them play an increasingly important role to support balancing the electricity system.

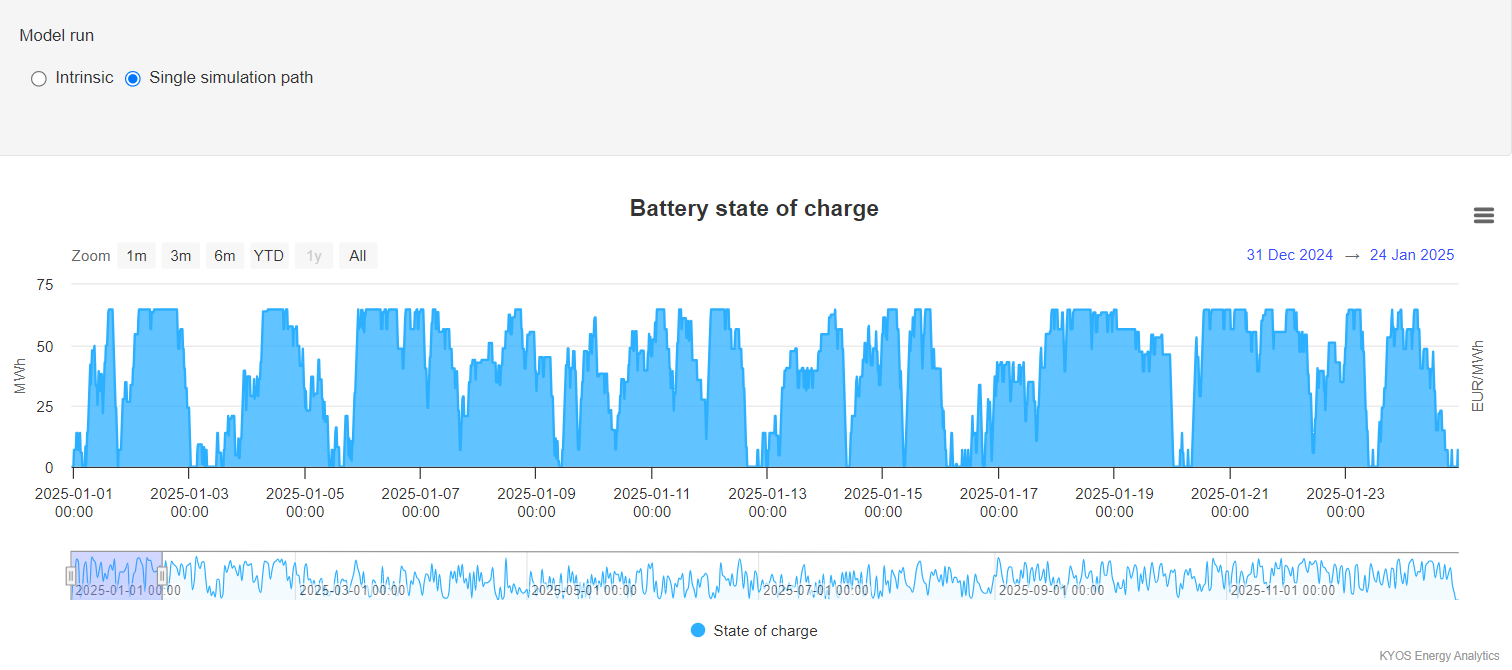

Our KyBattery tool supports traders and portfolio managers in electricity markets. Above all, the battery storage optimization software raises revenues from battery storage trading operations, and provides accurate valuations and reduces risk with adequate hedge recommendations. The model uses advanced stochastics including Least Squares Monte Carlo techniques to capture the full optionality in battery storage facilities.

Energy storage: What is a fair value?

First of all, our energy valuation model calculates the fair value of energy storage. KyBattery supports all types of energy storage assets, including pump-hydro, battery storage, compressed air energy storage (CAES) and heat storage. The model shows what value can be made in day-ahead, intra-day, balancing and ancillary services (FCR, aFRR). To capture the full battery value, you will need to exercise an active trading strategy in multiple market segments: revenue stacking is key to success.

Together with the KyBattery model, we provide bankable long-term energy price forecasts and simulations over horizons of up to 30 years for almost all European energy markets. Our expert team of market analysts maintains all input data and assumptions to generate bankable price forecasts with the KyPF fundamental power market model. The bankable forecasts form the basis for any energy storage business case. We provide a base case and alternative scenarios, plus a wide range of simulations for all market segments.

Features KyBattery

The KyBattery energy optimization software includes all common energy storage parameters: time dependent charge and discharge rates, costs and efficiencies, battery degradation, limits to the number of cycles, and reduced access to the grid. KyBattery also takes into account co-location of energy storage with renewable generation or other energy flows in your portfolio.

Of course we have fully integrated KyBattery in our KYOS Analytical Platform. Automated data feeds ensure that you get up-to-date values and trading assessments every day.

Methodology KyBattery

Advanced price simulation techniques provide the basis for the KyBattery software, using our KySim model. Important characteristics are a mean-reverting multi-factor model coupled with long-term, short-term and seasonal dynamics.

This is complemented with various methodologies to generate correlated simulations of intraday and imbalance prices, as well as ancillary service prices. In the case of co-located renewable generation assets, correlated simulations of renewable generation are also part of the simulation set.

Real-time optimizer

With our extensive knowledge of battery optimization, we have developed a real-time battery optimizer. It provides automatic trading signals based on the order book data in the intraday market, capturing the most profitable trading opportunities. A team of quants is actively working on it to extend the features and further improve performance. Ask us for more information about this new product and see how you can become a partner in its development: info@kyos.com.

Trusted by organizations all over the world

Other Solutions

Software - Energy Analytics

Do you need help with valuing a renewable investment project, PPAs, battery energy storage, power plant, electrolyser, gas storage, - or you need bankable price forecasting services, risk management advisory or an E-/CTRM system?

Read more ›Software - C/ETRM

Customize your own C/ETRM system, with advanced risk metrics and reporting tools. Bring together your physical commodity positions with financial contracts. This provides not only a complete picture of purchases and sales, but also of the financial risks you are exposed to.

Read more ›Price Analytics

Market prices, market price forecasts and simulations for short and long-term are essential ingredients in energy and commodity management. KYOS offers a suite of functions and quant models to create and analyze all these price series.

Read more ›Advisory & Data Services

KYOS Energy Consulting offers a wide range of services to support companies with managing their (renewable) production position. Our expert services range from a one-off deal valuation to a complete solution for the risk management of a portfolio of renewable generation assets and contracts.

Read more ›